Talk to the experts

Learn more about Extend and find out if it's the right solution for your business.

October 28, 2025 12:05 PM

Keeping up with business expenses is truly a balancing act. Between managing vendor payments, team purchases, and monthly closes, details pile up fast, and even small mistakes can cause big issues down the line.

That’s why regular expense checks matter. They give you and your finance team the confidence that what’s in your books truly reflects what’s happening in the business.

Let’s look at why expense reconciliation matters, how small businesses typically handle it, and how modern tools can make managing it all much smoother.

Expense reconciliation is the process of verifying that your company’s financial records match your actual spending. It ensures every dollar that leaves your business is recorded correctly and is tied to the right purchase, project, or department.

In practice, this means comparing receipts, invoices, and credit card transactions against what’s in your accounting system or expense reports. When everything lines up, you know your books are accurate. If something doesn’t, like a missing receipt, duplicate charge, or unapproved expense, you can catch it and fix it before it causes problems.

So, think of reconciliation as a financial checkup. It confirms that your data is clean, your records are trustworthy, and you make business decisions based on accurate numbers.

When running a small business, every dollar counts. Reviewing expenses on a regular basis is critical to staying profitable, preventing waste, and making smarter financial decisions.

Reconciliation gives you a clear view of business spending—who made each purchase, when it happened, and what it was for. That visibility helps you stay within budget and hold your team accountable. When employees track and verify their expenses, they are more mindful about how and when they spend company funds.

Accurate records also make tax season far less stressful. Regular reconciliation ensures your expense data is organized, categorized, and ready when it’s time to file. You’ll know which costs qualify for deductions, have documentation to support each one, and avoid costly errors that can cause you issues when filing.

Small mistakes add up fast. A canceled software subscription that keeps billing, an accidental double payment to a vendor, or a recurring charge no one notices can quietly eat into your budget. Reconciliation helps you spot these issues early, fix them quickly, and keep your cash where it belongs.

Many small businesses still rely on a manual approach to expense reconciliation. It usually looks like this:

While this process works, it demands a lot of time and attention that most small teams don’t have to spare. It’s a time-consuming and error-prone process where receipts tend to go missing, transactions are miscategorized, or numbers are entered incorrectly, especially when multiple people are making purchases.

Therefore, most businesses that go about expense management manually end up with delayed reporting, incomplete data, and the constant risk of errors slipping through unnoticed.

Manual reconciliation shouldn’t be the norm, especially as your business grows and better tools become available.

A better way to do it is by using a spend and expense management platform like Extend. With it, you can issue virtual cards for specific needs, set budgets and approval workflows, capture receipts automatically, and sync everything directly into your ERP. Every step, spend, track, and reconcile work together, so your books stay accurate without the manual lift.

Here’s a bit about how it works:

Forget about waiting for monthly statements to see where money’s going. Each transaction, whether it’s through a virtual card or Bill Pay, appears in real time across the web and mobile app. You can instantly see who made the purchase, where it happened, and what it was for. Employees can also upload receipts on the spot, and transactions automatically flow into the platform. That means no more chasing paperwork or guessing what a charge was weeks later; your records stay organized as business happens.

Plan ahead by assigning budgets and categories before any money goes out the door. Create a budget for “Marketing,” “Events,” or “Client Travel,” and empower employees to generate and manage their own virtual cards with spending limits, expiration dates, or approval rules. Each purchase is automatically labeled with its budget and category, keeping reconciliation clean and straightforward. Managers can review and approve expenses in just a few clicks, giving your team flexibility to spend responsibly while maintaining control over every transaction.

Extend connects seamlessly with accounting tools like QuickBooks and NetSuite, so your expense data stays in sync from start to finish. Transactions, categories, and receipts are shared automatically, reducing duplicate entry and saving hours of admin work. The system updates expense reports and reimbursements in real time, keeping your books current and your close process faster. With fewer manual steps and cleaner data, your team can focus less on fixing spreadsheets and more on running the business.

Extend helps small teams move from spreadsheets and guesswork to a connected system that keeps every dollar accounted for. You get better visibility, less manual work, and faster reconciliation.

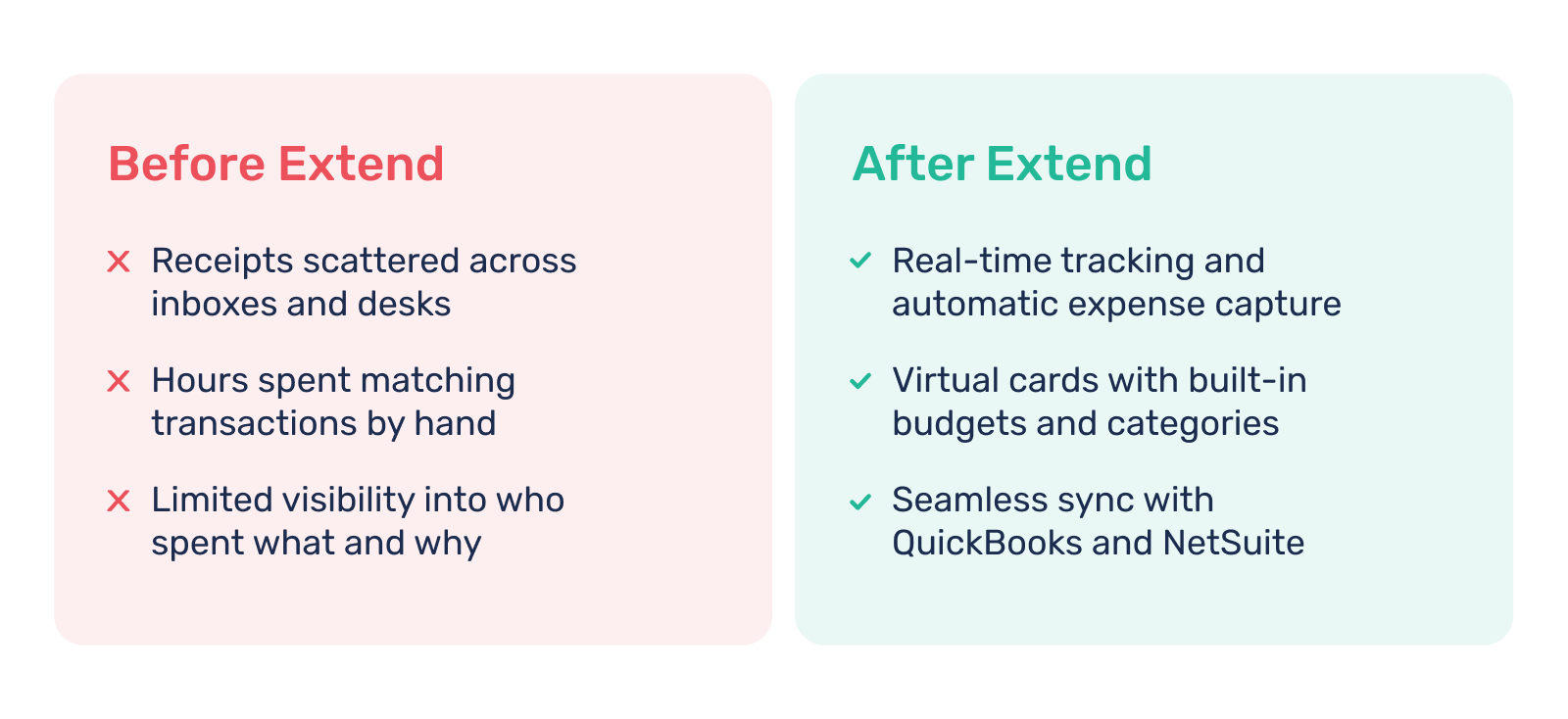

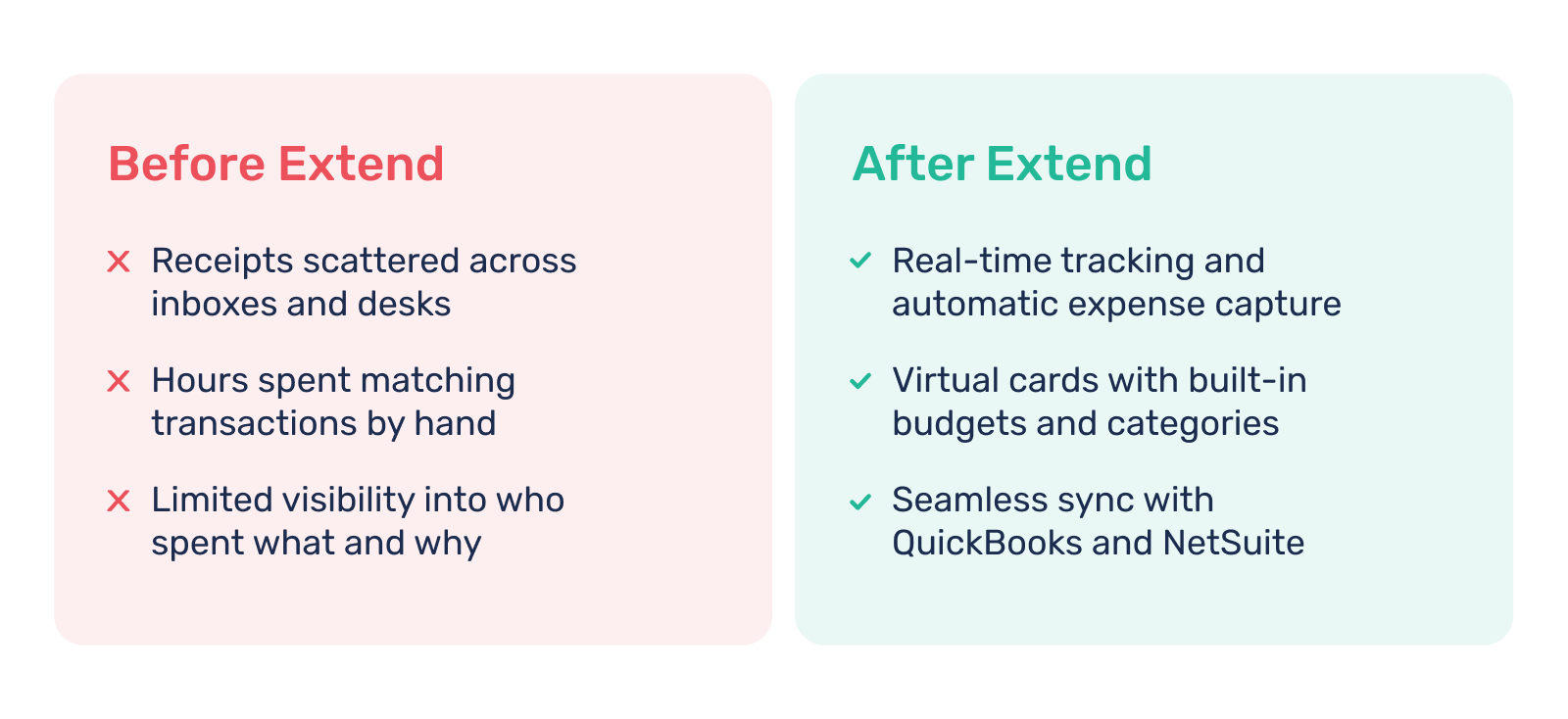

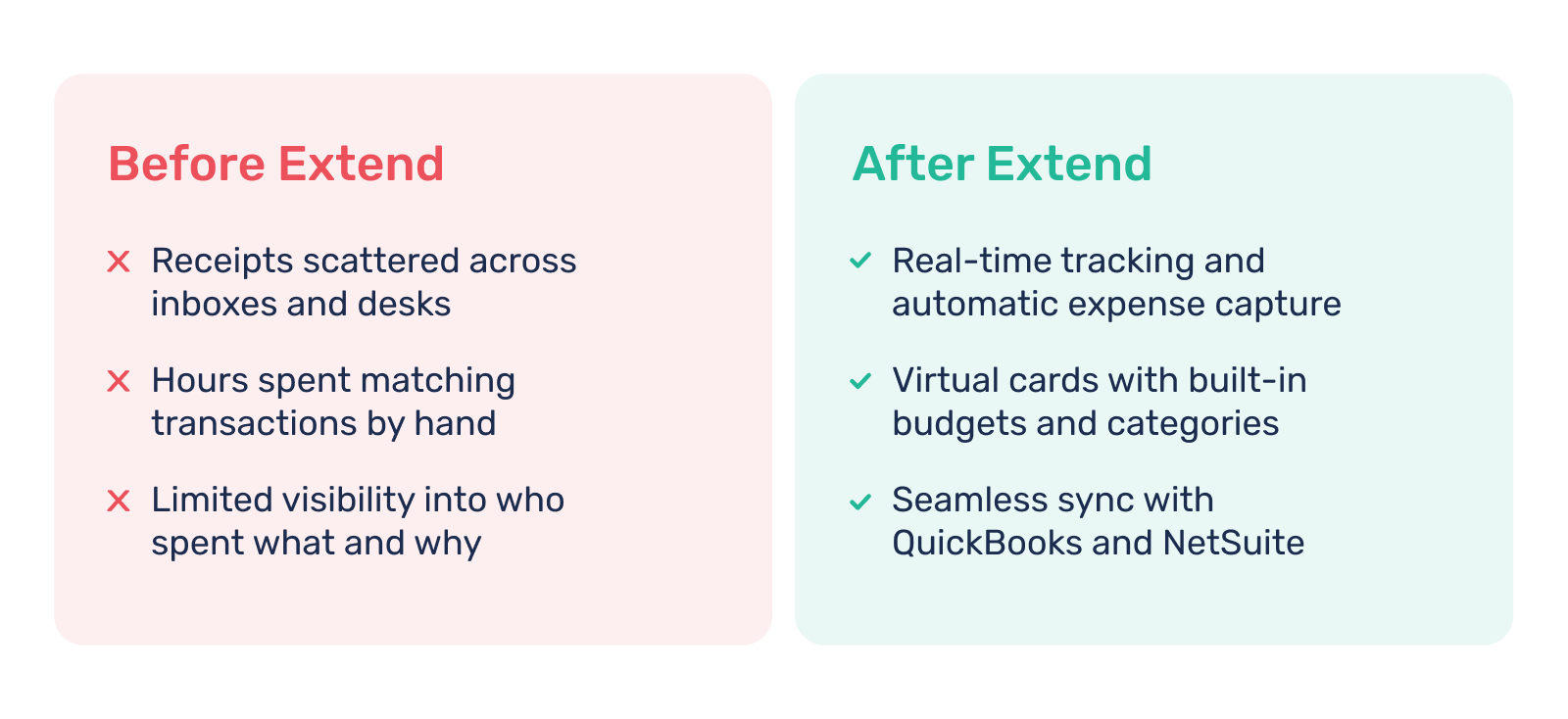

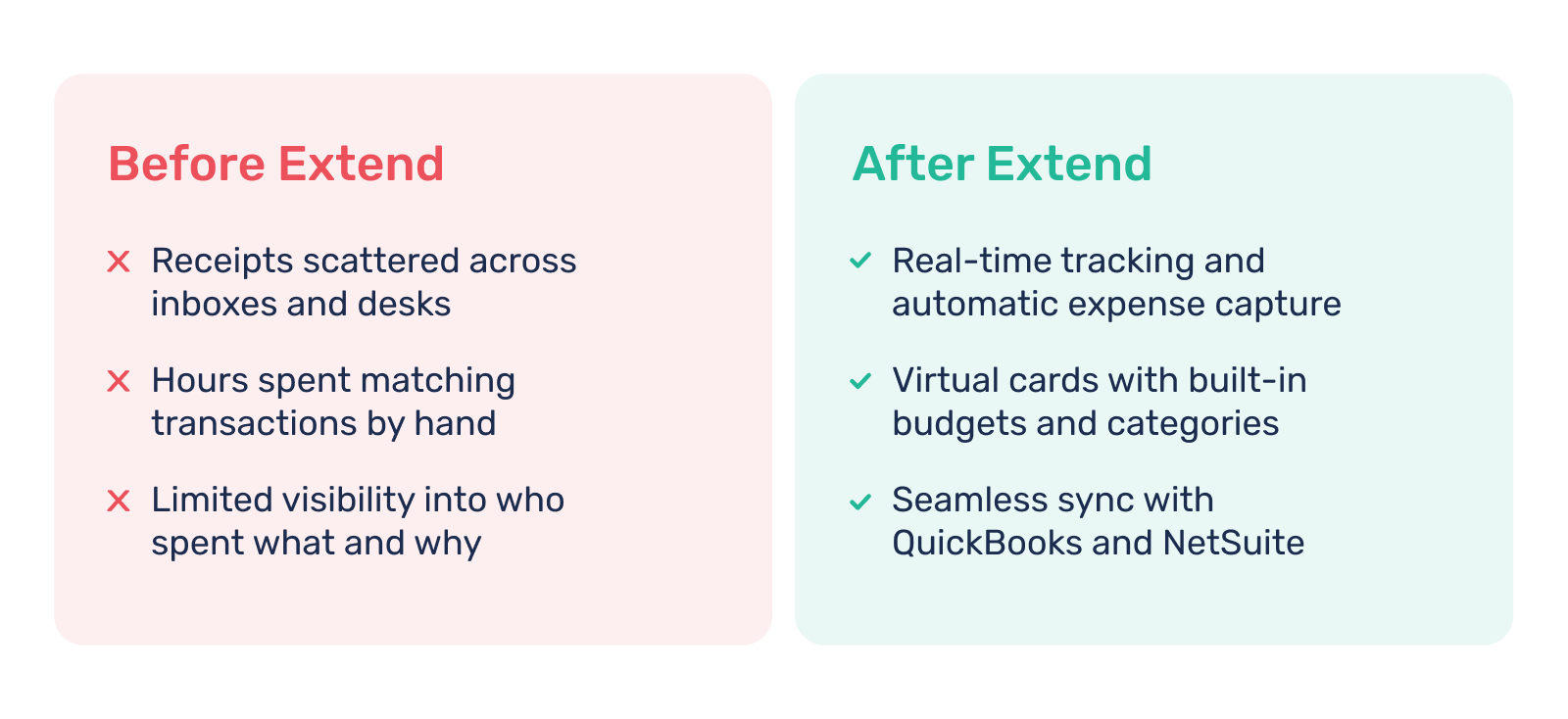

You can go from:

Take Central Construction, as an example. After switching to Extend, they reduced reconciliation time by 44 hours each month, saving more than $21,000 a year in labor costs and gaining full visibility into company spend across every project.

Dawn Lewis

Controller at Couranto

Bridget Cobb

Staff Accountant at Healthstream

Brittany Nolan

Sr. Product Marketing Manager at Extend (moderator)

.png)

Keeping up with business expenses is truly a balancing act. Between managing vendor payments, team purchases, and monthly closes, details pile up fast, and even small mistakes can cause big issues down the line.

That’s why regular expense checks matter. They give you and your finance team the confidence that what’s in your books truly reflects what’s happening in the business.

Let’s look at why expense reconciliation matters, how small businesses typically handle it, and how modern tools can make managing it all much smoother.

Expense reconciliation is the process of verifying that your company’s financial records match your actual spending. It ensures every dollar that leaves your business is recorded correctly and is tied to the right purchase, project, or department.

In practice, this means comparing receipts, invoices, and credit card transactions against what’s in your accounting system or expense reports. When everything lines up, you know your books are accurate. If something doesn’t, like a missing receipt, duplicate charge, or unapproved expense, you can catch it and fix it before it causes problems.

So, think of reconciliation as a financial checkup. It confirms that your data is clean, your records are trustworthy, and you make business decisions based on accurate numbers.

When running a small business, every dollar counts. Reviewing expenses on a regular basis is critical to staying profitable, preventing waste, and making smarter financial decisions.

Reconciliation gives you a clear view of business spending—who made each purchase, when it happened, and what it was for. That visibility helps you stay within budget and hold your team accountable. When employees track and verify their expenses, they are more mindful about how and when they spend company funds.

Accurate records also make tax season far less stressful. Regular reconciliation ensures your expense data is organized, categorized, and ready when it’s time to file. You’ll know which costs qualify for deductions, have documentation to support each one, and avoid costly errors that can cause you issues when filing.

Small mistakes add up fast. A canceled software subscription that keeps billing, an accidental double payment to a vendor, or a recurring charge no one notices can quietly eat into your budget. Reconciliation helps you spot these issues early, fix them quickly, and keep your cash where it belongs.

Many small businesses still rely on a manual approach to expense reconciliation. It usually looks like this:

While this process works, it demands a lot of time and attention that most small teams don’t have to spare. It’s a time-consuming and error-prone process where receipts tend to go missing, transactions are miscategorized, or numbers are entered incorrectly, especially when multiple people are making purchases.

Therefore, most businesses that go about expense management manually end up with delayed reporting, incomplete data, and the constant risk of errors slipping through unnoticed.

Manual reconciliation shouldn’t be the norm, especially as your business grows and better tools become available.

A better way to do it is by using a spend and expense management platform like Extend. With it, you can issue virtual cards for specific needs, set budgets and approval workflows, capture receipts automatically, and sync everything directly into your ERP. Every step, spend, track, and reconcile work together, so your books stay accurate without the manual lift.

Here’s a bit about how it works:

Forget about waiting for monthly statements to see where money’s going. Each transaction, whether it’s through a virtual card or Bill Pay, appears in real time across the web and mobile app. You can instantly see who made the purchase, where it happened, and what it was for. Employees can also upload receipts on the spot, and transactions automatically flow into the platform. That means no more chasing paperwork or guessing what a charge was weeks later; your records stay organized as business happens.

Plan ahead by assigning budgets and categories before any money goes out the door. Create a budget for “Marketing,” “Events,” or “Client Travel,” and empower employees to generate and manage their own virtual cards with spending limits, expiration dates, or approval rules. Each purchase is automatically labeled with its budget and category, keeping reconciliation clean and straightforward. Managers can review and approve expenses in just a few clicks, giving your team flexibility to spend responsibly while maintaining control over every transaction.

Extend connects seamlessly with accounting tools like QuickBooks and NetSuite, so your expense data stays in sync from start to finish. Transactions, categories, and receipts are shared automatically, reducing duplicate entry and saving hours of admin work. The system updates expense reports and reimbursements in real time, keeping your books current and your close process faster. With fewer manual steps and cleaner data, your team can focus less on fixing spreadsheets and more on running the business.

Extend helps small teams move from spreadsheets and guesswork to a connected system that keeps every dollar accounted for. You get better visibility, less manual work, and faster reconciliation.

You can go from:

Take Central Construction, as an example. After switching to Extend, they reduced reconciliation time by 44 hours each month, saving more than $21,000 a year in labor costs and gaining full visibility into company spend across every project.

Keeping up with business expenses is truly a balancing act. Between managing vendor payments, team purchases, and monthly closes, details pile up fast, and even small mistakes can cause big issues down the line.

That’s why regular expense checks matter. They give you and your finance team the confidence that what’s in your books truly reflects what’s happening in the business.

Let’s look at why expense reconciliation matters, how small businesses typically handle it, and how modern tools can make managing it all much smoother.

Expense reconciliation is the process of verifying that your company’s financial records match your actual spending. It ensures every dollar that leaves your business is recorded correctly and is tied to the right purchase, project, or department.

In practice, this means comparing receipts, invoices, and credit card transactions against what’s in your accounting system or expense reports. When everything lines up, you know your books are accurate. If something doesn’t, like a missing receipt, duplicate charge, or unapproved expense, you can catch it and fix it before it causes problems.

So, think of reconciliation as a financial checkup. It confirms that your data is clean, your records are trustworthy, and you make business decisions based on accurate numbers.

When running a small business, every dollar counts. Reviewing expenses on a regular basis is critical to staying profitable, preventing waste, and making smarter financial decisions.

Reconciliation gives you a clear view of business spending—who made each purchase, when it happened, and what it was for. That visibility helps you stay within budget and hold your team accountable. When employees track and verify their expenses, they are more mindful about how and when they spend company funds.

Accurate records also make tax season far less stressful. Regular reconciliation ensures your expense data is organized, categorized, and ready when it’s time to file. You’ll know which costs qualify for deductions, have documentation to support each one, and avoid costly errors that can cause you issues when filing.

Small mistakes add up fast. A canceled software subscription that keeps billing, an accidental double payment to a vendor, or a recurring charge no one notices can quietly eat into your budget. Reconciliation helps you spot these issues early, fix them quickly, and keep your cash where it belongs.

Many small businesses still rely on a manual approach to expense reconciliation. It usually looks like this:

While this process works, it demands a lot of time and attention that most small teams don’t have to spare. It’s a time-consuming and error-prone process where receipts tend to go missing, transactions are miscategorized, or numbers are entered incorrectly, especially when multiple people are making purchases.

Therefore, most businesses that go about expense management manually end up with delayed reporting, incomplete data, and the constant risk of errors slipping through unnoticed.

Manual reconciliation shouldn’t be the norm, especially as your business grows and better tools become available.

A better way to do it is by using a spend and expense management platform like Extend. With it, you can issue virtual cards for specific needs, set budgets and approval workflows, capture receipts automatically, and sync everything directly into your ERP. Every step, spend, track, and reconcile work together, so your books stay accurate without the manual lift.

Here’s a bit about how it works:

Forget about waiting for monthly statements to see where money’s going. Each transaction, whether it’s through a virtual card or Bill Pay, appears in real time across the web and mobile app. You can instantly see who made the purchase, where it happened, and what it was for. Employees can also upload receipts on the spot, and transactions automatically flow into the platform. That means no more chasing paperwork or guessing what a charge was weeks later; your records stay organized as business happens.

Plan ahead by assigning budgets and categories before any money goes out the door. Create a budget for “Marketing,” “Events,” or “Client Travel,” and empower employees to generate and manage their own virtual cards with spending limits, expiration dates, or approval rules. Each purchase is automatically labeled with its budget and category, keeping reconciliation clean and straightforward. Managers can review and approve expenses in just a few clicks, giving your team flexibility to spend responsibly while maintaining control over every transaction.

Extend connects seamlessly with accounting tools like QuickBooks and NetSuite, so your expense data stays in sync from start to finish. Transactions, categories, and receipts are shared automatically, reducing duplicate entry and saving hours of admin work. The system updates expense reports and reimbursements in real time, keeping your books current and your close process faster. With fewer manual steps and cleaner data, your team can focus less on fixing spreadsheets and more on running the business.

Extend helps small teams move from spreadsheets and guesswork to a connected system that keeps every dollar accounted for. You get better visibility, less manual work, and faster reconciliation.

You can go from:

Take Central Construction, as an example. After switching to Extend, they reduced reconciliation time by 44 hours each month, saving more than $21,000 a year in labor costs and gaining full visibility into company spend across every project.

.png)

Keeping up with business expenses is truly a balancing act. Between managing vendor payments, team purchases, and monthly closes, details pile up fast, and even small mistakes can cause big issues down the line.

That’s why regular expense checks matter. They give you and your finance team the confidence that what’s in your books truly reflects what’s happening in the business.

Let’s look at why expense reconciliation matters, how small businesses typically handle it, and how modern tools can make managing it all much smoother.

Expense reconciliation is the process of verifying that your company’s financial records match your actual spending. It ensures every dollar that leaves your business is recorded correctly and is tied to the right purchase, project, or department.

In practice, this means comparing receipts, invoices, and credit card transactions against what’s in your accounting system or expense reports. When everything lines up, you know your books are accurate. If something doesn’t, like a missing receipt, duplicate charge, or unapproved expense, you can catch it and fix it before it causes problems.

So, think of reconciliation as a financial checkup. It confirms that your data is clean, your records are trustworthy, and you make business decisions based on accurate numbers.

When running a small business, every dollar counts. Reviewing expenses on a regular basis is critical to staying profitable, preventing waste, and making smarter financial decisions.

Reconciliation gives you a clear view of business spending—who made each purchase, when it happened, and what it was for. That visibility helps you stay within budget and hold your team accountable. When employees track and verify their expenses, they are more mindful about how and when they spend company funds.

Accurate records also make tax season far less stressful. Regular reconciliation ensures your expense data is organized, categorized, and ready when it’s time to file. You’ll know which costs qualify for deductions, have documentation to support each one, and avoid costly errors that can cause you issues when filing.

Small mistakes add up fast. A canceled software subscription that keeps billing, an accidental double payment to a vendor, or a recurring charge no one notices can quietly eat into your budget. Reconciliation helps you spot these issues early, fix them quickly, and keep your cash where it belongs.

Many small businesses still rely on a manual approach to expense reconciliation. It usually looks like this:

While this process works, it demands a lot of time and attention that most small teams don’t have to spare. It’s a time-consuming and error-prone process where receipts tend to go missing, transactions are miscategorized, or numbers are entered incorrectly, especially when multiple people are making purchases.

Therefore, most businesses that go about expense management manually end up with delayed reporting, incomplete data, and the constant risk of errors slipping through unnoticed.

Manual reconciliation shouldn’t be the norm, especially as your business grows and better tools become available.

A better way to do it is by using a spend and expense management platform like Extend. With it, you can issue virtual cards for specific needs, set budgets and approval workflows, capture receipts automatically, and sync everything directly into your ERP. Every step, spend, track, and reconcile work together, so your books stay accurate without the manual lift.

Here’s a bit about how it works:

Forget about waiting for monthly statements to see where money’s going. Each transaction, whether it’s through a virtual card or Bill Pay, appears in real time across the web and mobile app. You can instantly see who made the purchase, where it happened, and what it was for. Employees can also upload receipts on the spot, and transactions automatically flow into the platform. That means no more chasing paperwork or guessing what a charge was weeks later; your records stay organized as business happens.

Plan ahead by assigning budgets and categories before any money goes out the door. Create a budget for “Marketing,” “Events,” or “Client Travel,” and empower employees to generate and manage their own virtual cards with spending limits, expiration dates, or approval rules. Each purchase is automatically labeled with its budget and category, keeping reconciliation clean and straightforward. Managers can review and approve expenses in just a few clicks, giving your team flexibility to spend responsibly while maintaining control over every transaction.

Extend connects seamlessly with accounting tools like QuickBooks and NetSuite, so your expense data stays in sync from start to finish. Transactions, categories, and receipts are shared automatically, reducing duplicate entry and saving hours of admin work. The system updates expense reports and reimbursements in real time, keeping your books current and your close process faster. With fewer manual steps and cleaner data, your team can focus less on fixing spreadsheets and more on running the business.

Extend helps small teams move from spreadsheets and guesswork to a connected system that keeps every dollar accounted for. You get better visibility, less manual work, and faster reconciliation.

You can go from:

Take Central Construction, as an example. After switching to Extend, they reduced reconciliation time by 44 hours each month, saving more than $21,000 a year in labor costs and gaining full visibility into company spend across every project.

Learn more about Extend and find out if it's the right solution for your business.