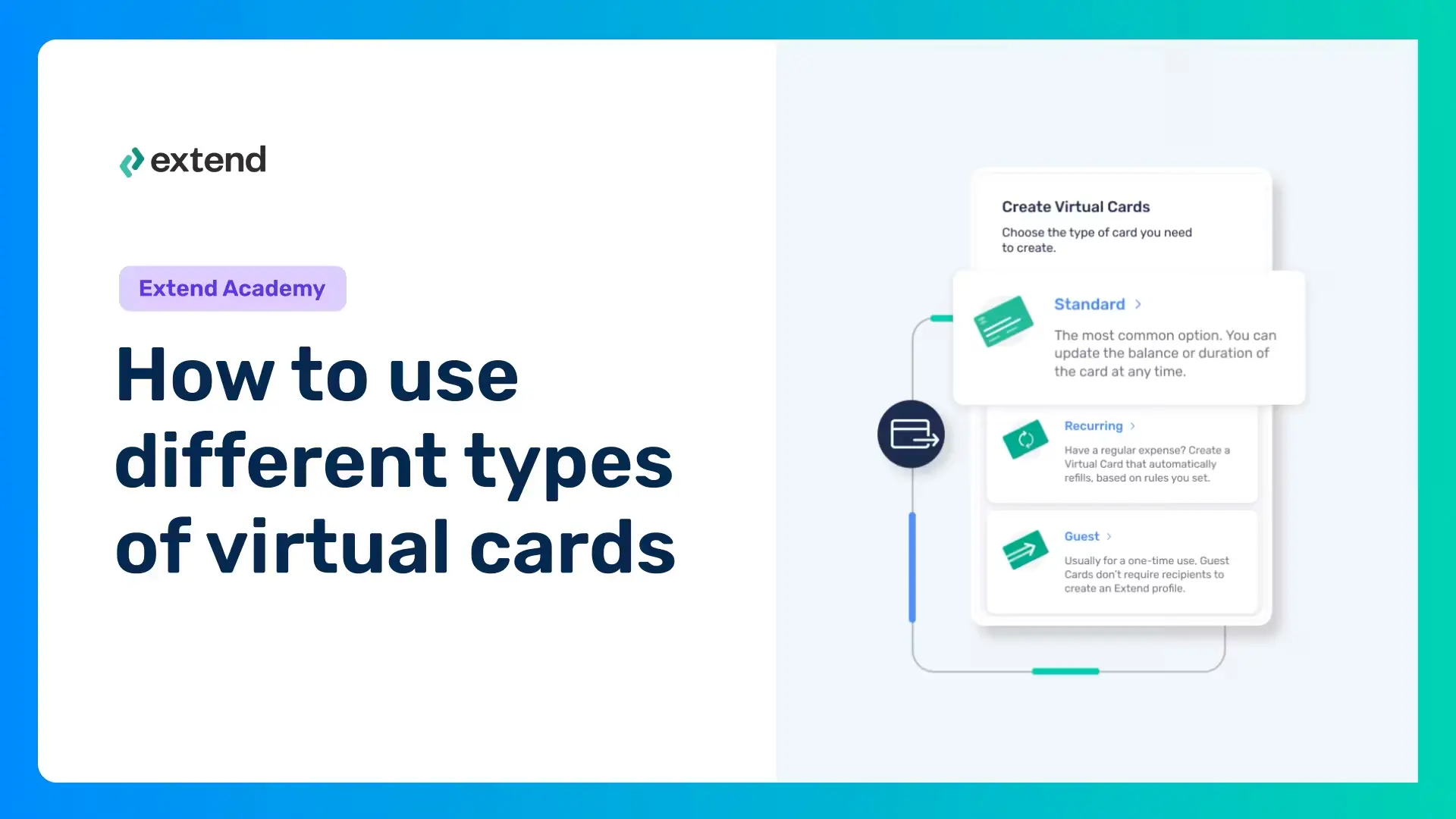

There are a couple different types of virtual cards you can create in Extend. In this video, you'll learn how they're different and what they can be used for.

- Standard cards: This type of virtual card is perfect for regular spending needs.

- Recurring cards: Use this type of virtual card for monthly subscription payments, recurring vendor chargers, or to manage employee spending on a daily, weekly, or monthly basis.

- Guest cards: This type of card is designed for anyone outside of your organization in Extend. They’re ideal for vendors, contractors, or people who need to make business payments but don’t work at your company.

- Recurring guest cards: Use them for anyone outside of your organization in Extend who needs access to company funds on a recurring basis.

Consider using virtual cards to:

Empower your workforce: Allowing employees to pay with a virtual card is more convenient and ensures managing business purchases can be done securely and efficiently, enhancing overall employee spend management.

Pay vendors quickly and easily: Using virtual cards ensures speedy and effortless transactions, making them ideal as a freelancer payment method or to take care of vendor and subscription payments.

Manage expenses by client or project: Virtual cards for spend management unlock precise tracking of expenses on a client or project basis, offering a sophisticated solution for company spend management.

Capture more data: Each virtual card transaction provides detailed data, aiding in reconciliation and analysis for CFOs and financial teams looking for payment innovation.

Streamline bookkeeping: Simplifying your accounting processes is simple with a spend management app. Simply integrate virtual cards with your accounting software and watch bookkeeping and reconciliation become more efficient and accurate.