Try our demo

Features

Virtual cards

Budgets

Bill pay

✨New!

Receipt management

Reimbursements

Reconciliation

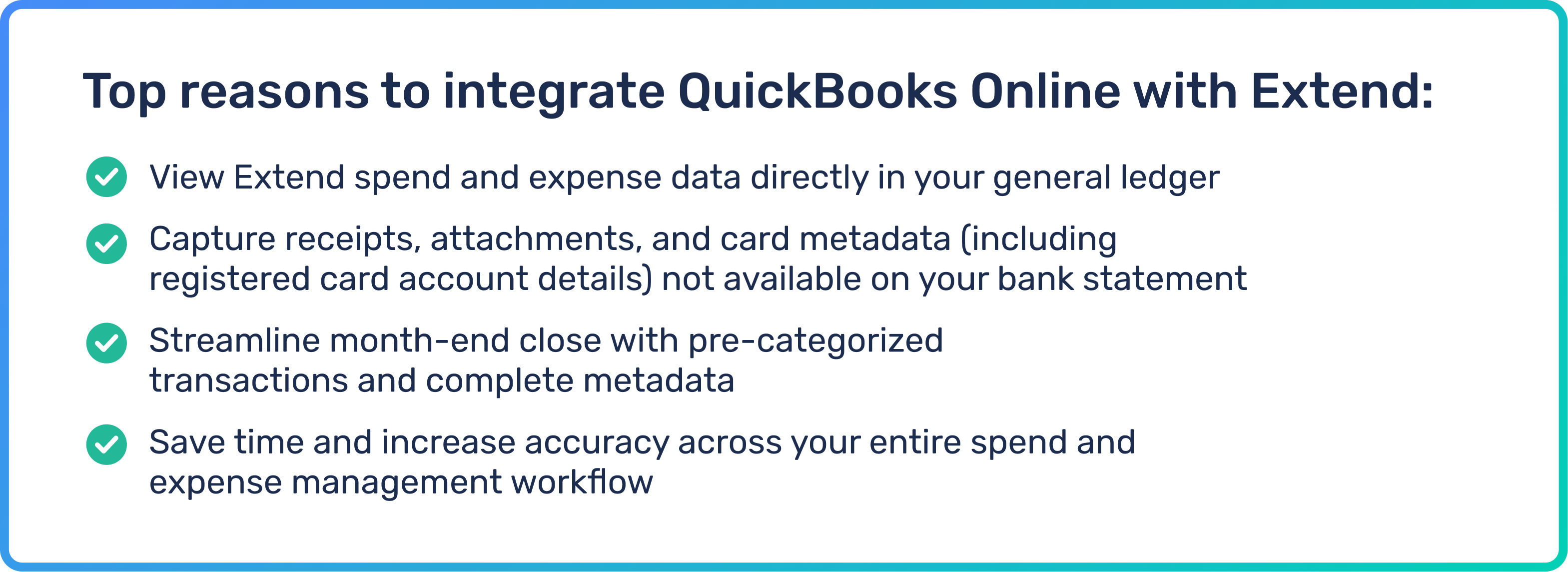

Integrations

Explore all features

Participating banks

American Express

Banc of California

BMO

City National Bank

Corpay

HSBC

PNC

Regions Bank

Silicon Valley Bank

Texas Capital

Empowering teams & staying on budget with Levin + Riegner

Extend for

Vendor payments

Pay vendors, make purchases, and manage subscriptions with the control and security of virtual cards.

Virtual employee cards

Empower employees to manage expenses with accountability and transparency.

Expense management

Automate manual processes and get a centralized view of expenses across all the company credit cards.

Tracking spend

Gain real-time visibility over every charge

Reconciliation

Close your books in a fraction of the time

Integrated payments

Automate payment workflows and manage transactions at scale with our flexible virtual card API.

Custom AI agents

Integrate our API into your agentic workflows to achieve a whole new level of automation and efficiency